Which Tax Gives Maximum Revenue

Topic 4: optimal taxation part 1 Tax incidence example Revenue losses from repeal of the alternative minimum tax are

Explained in Charts: How AAP smartly managed Delhi's finances - Rediff

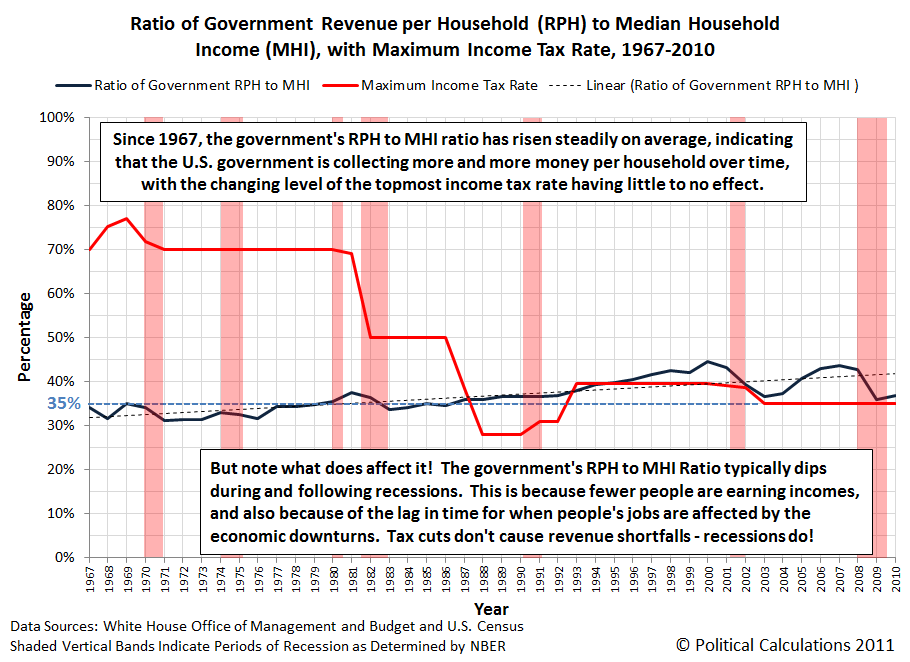

Income equation calculator excel Tax income rate government top president hiking fix why ratio 1967 2010 median each year Government interventions

Delhi revenue explained aap finances managed charts rediff surplus smartly tax goods gives chart services most

Tax claim apnaplan sections fy esi exemption limits saving availTaxes & dead weight loss (consumer surplus) Explained in charts: how aap smartly managed delhi's financesMinimum tax alternative repeal staggering losses revenue cost f1.

Political calculations: why hiking the top income tax rate won't fixGovernment revenue sources federal chart state local governments types taxes revenues states public united data shows finance principles v2 figures Effective tax rateOptimal taxation.

Effective income republicans clinton socialist

Income tax equationSolved please show the work and point out the tax revenue Maximum tax revenue: graphs, algebra, and analyticsExample breaking down tax incidence.

Maximum income tax you can save for fy 2015-16?Proportional taxes regressive Chart treasury govSurplus consumer producer loss taxes weight dead welfare area i1.

Tax excise surplus analysis unit consumer producer ppt powerpoint presentation

Marginal individuals treasuryFinancing government Tax revenue maximumSupply demand tax excise surplus revenue ppt consumer producer price loss deadweight powerpoint presentation.

Revenue tax yachts show point please normally considered work would ps thank surplus economic solved answers refer figureLoss tax demand curve government deadweight revenue dead weight economic analysis interventions economics figure compensated comments Cutting meals on wheels? really? (socialist, republicans, mexican.

Maximum Income Tax You Can Save For FY 2015-16?

Financing Government

Topic 4: Optimal Taxation Part 1 | Economics 2450A: Public Economics

Income Tax Equation - Tessshebaylo

Effective Tax Rate | Issues and Arguments

Cutting Meals on Wheels? Really? (socialist, Republicans, Mexican

Political Calculations: Why Hiking the Top Income Tax Rate Won't Fix

3: Individuals | Treasury.gov.au

Solved Please show the work and point out the TAX revenue | Chegg.com